Model of LNG tanker is seen in this illustration taken May 19, 2022. Photo: Reuters

The only exception in Asia so far in 2025 has been Taiwan, which luckily for liquefied natural gas exporters is primed to substantially lift its gas dependence following the closure of its last remaining nuclear reactor last month.

Indeed, forecasts for a stretch of above-normal temperatures this summer have the potential to sharply raise Taiwan's thermal power needs over the coming months, and may set the stage for a fresh rise in LNG orders by Taiwan's power producers.

Sole standout

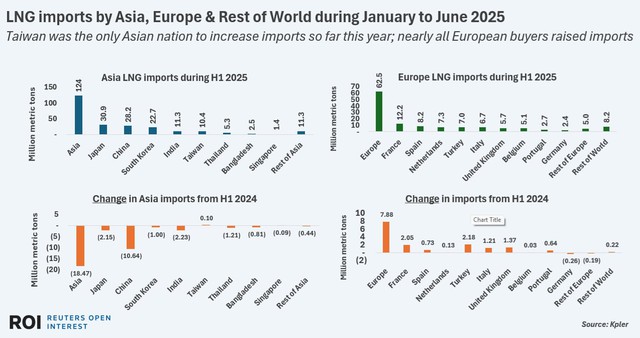

During the first half of 2025, all major LNG importers in Asia aside from Taiwan reduced LNG purchases from the same period a year ago, data from commodities data firm Kpler shows.

LNG imports by Asia, Europe & Rest of World during January to June 2025

As Asia imports roughly two-thirds of all LNG supplies, this widespread demand downturn in such a key region has placed several LNG exporters under strain, and has led to a 16% fall in Asia LNG spot prices so far this year.

Five of the six largest LNG importers so far in 2025 are in Asia: Japan, China, South Korea, India and Taiwan.

Between them, those countries have registered a collective 16 million metric ton drop in LNG imports during the first half of the year compared to the same months in 2024.

Taiwan, which ranks sixth in LNG orders so far in 2025, has notched up a modest 100,000 ton increase in LNG orders from a year ago, Kpler data shows.

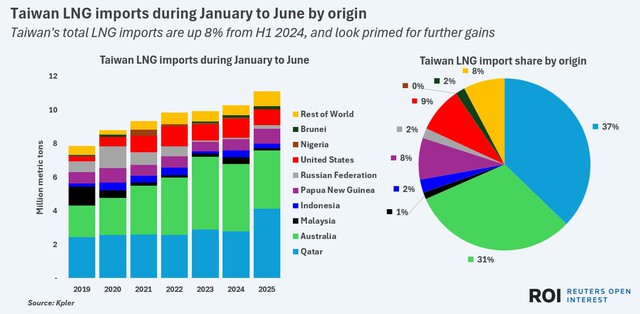

Taiwan LNG imports during January to June by origin

But there are reasons Taiwan's appetite for LNG could climb further in the months ahead.

Nuclear cut

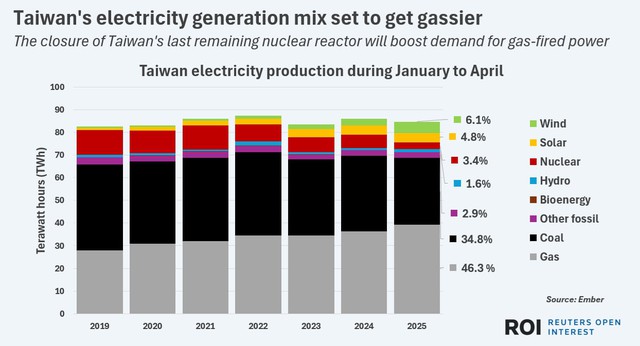

The main driver of gas demand potential is the need for power firms to replace the power lost from the recent closure of Taiwan's last remaining nuclear reactor.

Unit two of the Maanshan nuclear reactor was disconnected from Taiwan's grid around the middle of last month, which marked the end of a 40-year run for nuclear power in Taiwan.

Power firms have been planning for the nuclear shutdown for months, and steadily reduced nuclear-powered electricity generation accordingly from around 1 terawatt hour (TWh) per month in 2024 to around 0.7 TWh in April, Ember data shows.

Taiwan's electricity generation mix set to get gassier

As Taiwan's gas-fired power plants generate roughly 10 TWh a month and coal plants around 7.5 TWh a month, power firms have so far been able to accommodate the nuclear cuts with ease.

The country's growing output from solar farms - which generate around 1.5 TWh of electricity a month over the summer - have also helped offset some of the loss of nuclear generation.

Hot spell

Going forward, however, Taiwan's utilities will likely need to increase generation from all available resources in order to meet system demand needs, which tend to rise sharply over the summer due to higher cooling demand.

Between 2022 and 2024, Taiwan's total electricity demand increased by an average of 23% between April and July, from around 22.4 TWh a month to 27.4 TWh a month, Ember data shows.

With nuclear plants now out of the equation, natural gas and coal plants will need to provide most of that additional power, and already account for around 46% and 35% respectively of total electricity supplies.

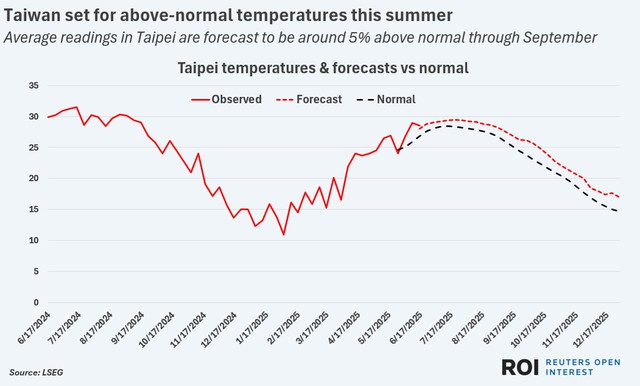

The challenge this year is that total demand could potentially rise by more than expected due to forecasts for a sustained stretch of above-normal temperatures this summer.

Taiwan set for above-normal temperatures this summer

Between now and the end of September, temperatures are expected to average around 28.4 degrees Celsius (83.1 degrees Fahrenheit) in Taipei, according to forecasts from LSEG.

That forecast is around 5% more than the long-term average for that period, and indicates a likely sustained bout of strong air conditioner use across Taiwan.

That in turn suggests that Taiwan's coal and gas plants could face a spate of above-normal capacity utilisation which may result in a speedier-than-normal draw on gas and coal inventories.

That's good news for LNG exporters, who have been consistently disappointed by demand in Asia so far this year but may now be on the cusp of period of Taiwan-driven stronger interest in the region.

Max: 1500 characters

There are no comments yet. Be the first to comment.