Employees are at work at a footwear factory in Hanoi. Photo: Reuters

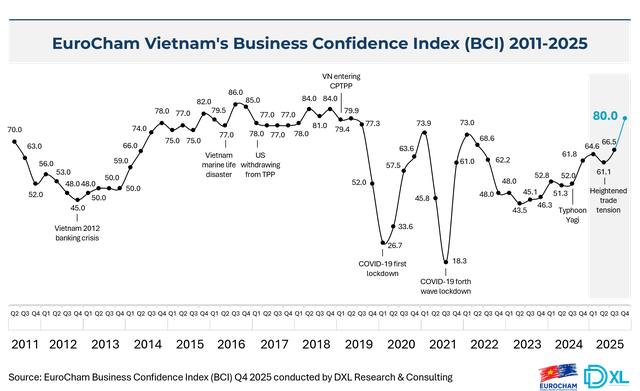

Rising sharply to 80.0 points, the index signals a return to strong confidence after nearly a decade marked by disruption, volatility, and prolonged neutrality, even as global trade tensions and geopolitical uncertainty continue to weigh on the international environment.

The BCI captures European business sentiment across sectors and company sizes, providing a data-driven snapshot of how firms assess their operating environment, future prospects, and investment priorities.

Decisive surge in optimism

The index surged by 13.5 points to reach 80.0, ending a seven-year period of successive shocks, from the pandemic to global trade frictions, which repeatedly tested sentiment despite Vietnam’s solid economic fundamentals.

This rebound represents one of the strongest upward movements since the BCI’s launch in 2011 and reflects broad-based improvements across both current business conditions and future expectations.

In the fourth quarter of 2025, 65 percent of the respondents rated their current business situation as positive, while 69 percent expressed confidence in their outlook for the first quarter of 2026.

Realized business conditions in the fourth quarter of 2025 exceeded expectations set in the previous quarter.

Only 56 percent had anticipated positive conditions for the period when surveyed in the third quarter.

This shift closely mirrors Vietnam’s macroeconomic trajectory.

Vietnam’s GDP growth in the fourth quarter of 2025 reached 8.46 percent, the fastest quarterly expansion since the fourth quarter of 2007, and exceeded projections from major international institutions.

“Our latest BCI confirms what many of us have felt intuitively,” said EuroCham chairman Bruno Jaspaert.

“After years of hovering around the mid-line, reaching 80 tells us that confidence is now grounded in delivery – in factories running, orders returning, and investments being executed.

“We are seeing a structural shift where Vietnam is quickly transforming itself into a powerful growth engine, on track to rank among the top three economies in ASEAN."

Vietnam as ‘place to be:’ strong medium-term confidence

Beyond short-term gains, the Q4 2025 BCI reveals exceptionally strong confidence in Vietnam’s medium-term outlook.

An overwhelming 88 percent of the respondents expressed optimism about their organizations' prospects in Vietnam in the 2026-30 period, including 31 percent who described themselves as ‘very optimistic.’

“Over the next five to seven years, provided it plays its cards right, Vietnam is destined to become the place to be, rising to enter a golden era of growth and transformation,” said Jaspaert.

This sentiment is reinforced by performance trends.

As many as 60 percent of the companies polled reported improved business results in 2025 compared to 2024, while 82 percent expect further improvement in 2026, signaling confidence that current momentum will carry forward.

Vietnam’s appeal is further reinforced by strong peer endorsement.

Eighty-seven percent of the respondents said they are likely to recommend Vietnam as an investment destination to other foreign businesses, with confidence staying the highest among larger employers with substantial on-the-ground operations.

Administrative complexity: still top challenge, but easing

Administrative complexity and regulatory inconsistency remained the most frequently cited business challenges, but the Q4 data showed meaningful improvement.

As many as 53 percent of the respondents cited administrative burdens as a key concern, still high, but down 12 percentage points from the third quarter of 2025.

Other key frictions included unclear or inconsistently applied regulations (52 percent), followed by customs procedures and trade barriers, as well as visa and work permit constraints, each mentioned by around 33 percent of those surveyed.

Strategic priorities for 2026: growth with capability building

As confidence improves, European businesses are entering 2026 with a clear set of strategic priorities.

Business development and portfolio diversification top the agenda, cited by 50 percent of the pollees.

Talent remains a close second, with 45 percent prioritizing retention and recruitment, underscoring continued pressure on skilled labor availability and the importance of human capital in sustaining growth.

At the same time, 41 percent of the respondents highlight greater use of technology, automation, and AI, pointing to a parallel focus on efficiency, productivity, and long-term competitiveness.

European businesses recognize ongoing challenges, particularly administrative complexity and global volatility, but the data show that Vietnam’s growth momentum, reform trajectory, and investment fundamentals continue to underpin strong optimism.

As businesses enter 2026, they do so with measured optimism, backed by numbers, reforms in motion, and a growing conviction that Vietnam is not only resilient, but increasingly central to their long-term growth strategies.

“In 2026, EuroCham will continue to advocate for the removal of the remaining bottlenecks facing our members and the wider business community in Vietnam," Jaspaert concluded.

“Through our must-win battles, we are committed to driving forward regulatory changes that make a difference for both SMEs and MNCs."

Max: 1500 characters

There are no comments yet. Be the first to comment.