A general view of Mumbai's central financial district, India, November 22, 2017. REUTERS/Danish Siddiqui

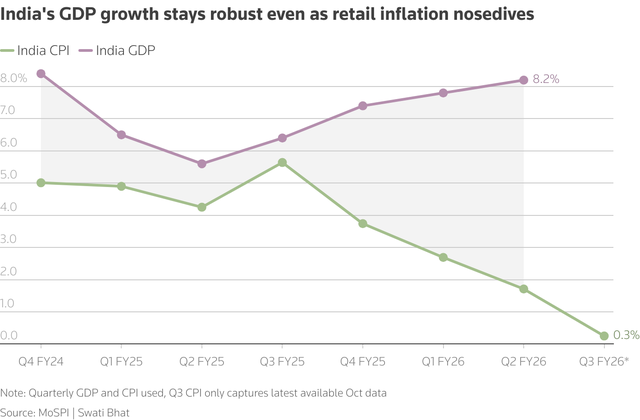

India's economy expanded at a sharper-than-expected clip of 8.2% in the July-September quarter, prompting analysts to raise their full-year growth estimates to above 7%.

That means the world's fifth-largest economy is expanding at a pace close to its estimated potential growth of 6.5%-7%. Potential growth is the rate an economy can expand without sparking inflation.

India's retail inflation, however, which slowed to a record-low 0.25% in October, is expected to remain benign for months.

"The December RBI policy will be set against a backdrop of resilient growth and ultra-low inflation. The stellar growth numbers reaffirm our view of a pause," said Gaura Sen Gupta, chief economist at IDFC First Bank.

"Space for easing is limited and should be utilised when downside risks to growth materialise," she said.

India's GDP growth stays robust even as retail inflation nosedives

A majority of economists in a Reuters poll conducted ahead of Friday's GDP data release had expected the Reserve Bank of India's key policy repo rate to be pared by 25 basis points to 5.25% on December 5, followed by a pause through 2026.

RBI's monetary policy committee has lowered the benchmark rate by 100 basis points in the first half of 2025 but has held it steady since August.

RBI Governor Sanjay Malhotra in an interview with Zee Business last week said there is scope to further reduce policy interest rates but that the timing of the move would depend on the committee.

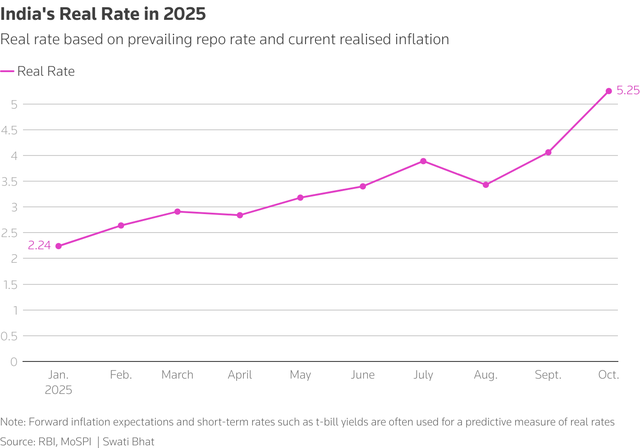

Real rate debate

"We think inflation has fallen more than anticipated and outlook for inflation also appears benign. So we expect the MPC to cut once (25 bps) to adjust real policy rate to reflect the change in inflation outcomes and outlook," said A. Prasanna, chief economist at ICICI Securities Primary Dealership.

At the current level of retail inflation, the neutral real rate - the repo rate minus inflation - is sharply higher but on a forward-inflation basis it is expected to be much lower. RBI's projection for inflation in the first quarter of fiscal year 2027 is 4.5% and its estimated neutral real rate falls in a range of 1.4% to 1.9%.

India's Real Rate in 2025

Those arguing for a cut also say growth will weaken in the second half of India's financial year ending on March 31, 2026.

Economists believe the punitive U.S. import tariff of 50% on Indian goods will hurt exports and employment across sectors like textiles and jewellery in coming months.

Barclays in a note on Friday said the GDP print is too hot to ignore and they no longer expect a rate cut on Friday.

Investors, however, are still hopeful for a rate cut, although expectations have been tempered by the GDP print.

Economists expect the RBI to further reduce its full-year inflation forecast from 2.6% while the full-year GDP estimate could be raised from the current 6.8%.

Max: 1500 characters

There are no comments yet. Be the first to comment.