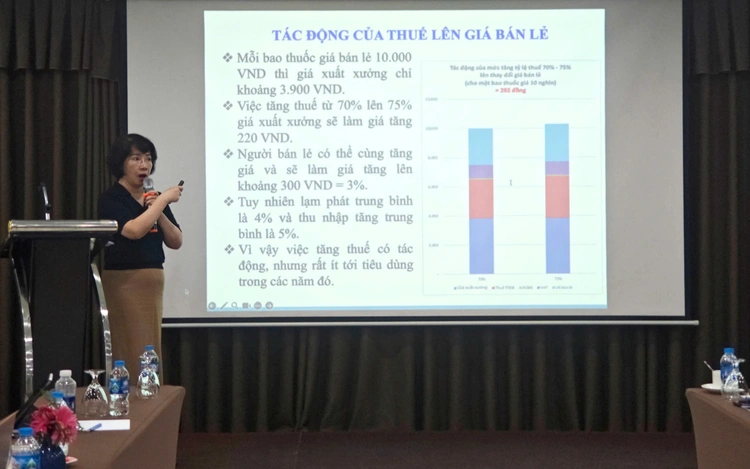

Phan Thi Hai, deputy director of the Vietnam Tobacco Control Fund under the Ministry of Health, presents tobacco-related data at an event discussing the impact of increased tobacco taxes on public health and market responses in Hanoi, April 23, 2025. Photo: D.Lieu / Tuoi Tre

Phan Thi Hai, deputy director of the Vietnam Tobacco Control Fund under the Ministry of Health, shared the alarming figure at a training session in Hanoi discussing the impact of increased tobacco taxes on public health and market responses, hosted by the Vietnam Center for Economic and Strategic Studies.

She highlighted that tobacco use remains a leading cause of disease and early mortality in the country.

Tobacco smoke contains 7,000 chemicals, including 69 carcinogens, and is linked to at least 25 diseases such as cancer, cardiovascular and respiratory conditions, and reproductive issues.

In Vietnam, tobacco use caused an estimated 104,300 deaths annually, with 85,500 from direct smoking and 18,800 from second-hand smoke, according to the World Health Organization’s data released in 2021.

“Tobacco use has placed a heavy burden on public health and reduced the quality of our labor force,” Hai said.

“Most people who die from tobacco-related illnesses are of working age.”

According to a 2022 estimate by the Vietnam Health Economics Association, the total costs associated with medical examinations, treatment, illness, and premature death due to smoking-related diseases amounted to VND108 trillion (US$4.2 billion) annually, equivalent to 1.14 percent of the country’s 2022 GDP.

This figure is more than five times the state revenue from tobacco taxes.

Despite this, Vietnam had raised tobacco excise taxes only three times between 2008 and 2019, with each hike limited to just five percent, and long gaps between the increases.

Currently, over 40 cigarette brands are sold for less than VND10,000 ($0.4) per pack, making tobacco easily accessible, especially to low-income individuals and youth.

Economist Nguyen Ngoc Anh, director of the Development and Policies Research Center, pointed out that even with tax hikes, tobacco consumption has not declined, with production and exports rising between 2008 and 2023.

He noted that cigarette affordability has improved dramatically.

In 1994, a consumer needed 31 percent of their annual income to buy 100 packs of cigarettes, but by 2017, it had dropped to just 5.2 percent.

Economist Dao The Son added that tobacco spending often displaces essential expenses such as education, especially in poorer households.

He argued that higher tobacco taxes could not only reduce smoking rates but also increase productivity, cut healthcare costs, and benefit the environment.

Son proposed raising the absolute excise tax on cigarettes to VND5,000 ($0.2) per pack in 2026 and VND15,000 ($0.6) by 2030.

To effectively reduce tobacco consumption, Hai emphasized the need for Vietnam to reform its tobacco tax policy by adding a substantial absolute tax, in order to shift toward a mixed taxation system.

She advocated a long-term plan that raises tobacco prices in line with income growth, aiming for tobacco taxes to eventually account for 75 percent of retail prices.

Max: 1500 characters

There are no comments yet. Be the first to comment.