EU takes small steps in uphill struggle to wean savers off cash

MILAN/MADRID -- A decade after it began working on a capital markets union, the EU is still struggling to agree a framework that encourages savers to put their cash to work within the bloc rather than in the U.S., prompting some of its 27 members to go it alone.

A woman pays with a twenty Euro bank note at the checkout in a supermarket in Chanverrie, France, October 16, 2024. REUTERS/Stephane Mahe

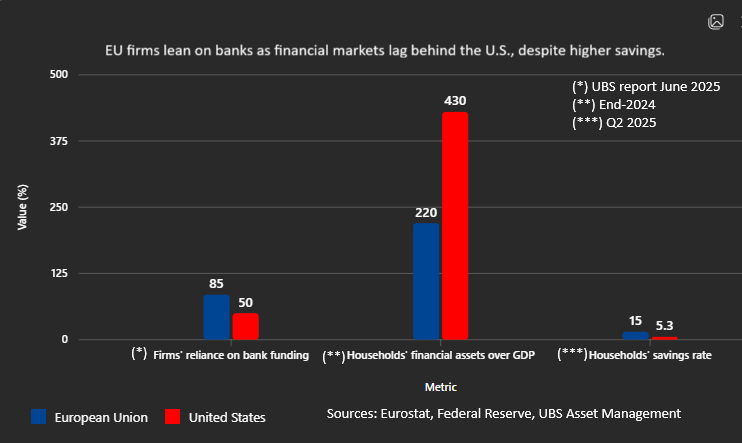

After warning in a 2024 report that 300 billion euros ($349 billion) of European Union savings leave the region annually, former Italian Prime Minister Enrico Letta last month said that ploughing funds into U.S. firms that reinvest in Europe was "a kind of collective suicide" caused by continued fragmentation.

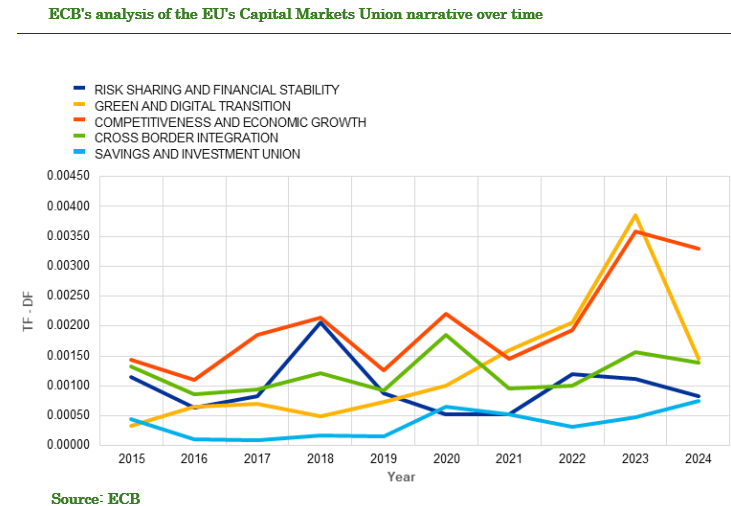

Despite more than 60 legislative proposals since 2015, national interests, technical complexity and shifting political priorities have hindered progress on market integration, a European Central Bank (ECB) study said in May.

A new package is due to be presented on Wednesday.

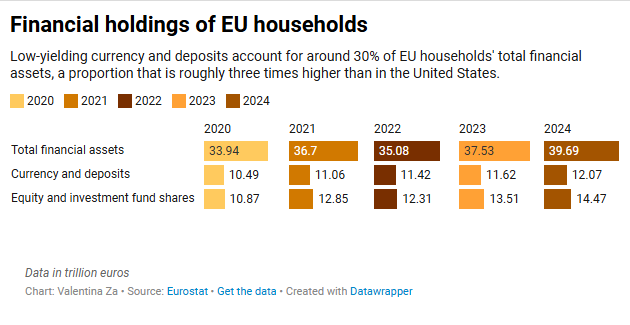

In the five years since the EU's latest action plan, households have stashed away 15% more in cash and bank deposits, raising the total to 12.1 trillion euros, equivalent to roughly 30% of their wealth, while in the U.S. just 11% sits in cash.

And in the euro zone's biggest and most populous economy the figure is higher still. Germans hold more than 40% of their financial assets in cash or bank deposits and only 12% in equities, its Council on Foreign Relations said last year.

EU households savings allocation choices

EU markets and savings

'Finance Europe' label to help savers

Seven countries, led by Spain, have started a pilot project that includes a proposed 'Finance Europe' label to help savers select investment products that back EU firms.

After identifying which instruments qualify, countries will assess whether regulations need tweaking and consult the private sector to gauge demand, officials told Reuters.

The plan is moving more slowly than expected, but Madrid could make an announcement early in 2026, one said.

Meanwhile, think tanks in Italy, France, Germany and Spain have proposed scaling Italy's Savings Investment Plan (PIR), which succeeded in funnelling residents' savings into the local economy, to the EU level.

Launched in 2017, the scheme raised 21 billion euros in its first five years, the minimum holding period required to qualify for tax exemptions, provided 70% of assets are invested in Italian companies.

"Instead of 70% in one member state's economy, it would be the EU economy, perhaps with a small fraction still reserved for domestic investments," said Fabrizio Pagani, a former Italian finance ministry official who designed PIR and is working on a similar EU-wide initiative.

European Commission President Ursula von der Leyen holds Former European Central Bank (ECB) chief Mario Draghi's report on EU competitiveness and recommendations, as they attend a press conference, in Brussels, Belgium September 9, 2024. REUTERS/Yves Herman/File Photo

Meanwhile, in its latest bloc-wide push to boost competitiveness against the faster-growing U.S. and China, the EU is due flesh out plans to advance its Savings and Investments Union (SIU) on Wednesday.

Among the proposals will be handing the European Securities and Markets Authority (ESMA) more power and measures to tackle cross-border barriers for asset managers and market facilities, a European Commission official told Reuters.

For Jan van Ewijk, senior policy adviser at the Dutch Authority for the Financial Markets (AFM), the SIU builds on the EU's Retail Investment Strategy (RIS), which originated in 2020 and awaits adoption into EU law.

However, the RIS has been overtaken by events, Van Ewijk told Reuters, pointing to the "new emphasis on simplification and burden reduction for the industry ... which was not part of the original narrative".

'I may be no expert, but I'm not stupid'

Risk aversion is also hurting EU households.

A report by former ECB President Mario Draghi noted their net wealth grew by 55% between 2009 and 2023, compared with 151% in the U.S.

ECB analysis of the CMU narrative

That partly reflects the low remuneration of current accounts which in the euro area returned just 0.25% on average in September, rising to 1.78% on deposits with an agreed maturity but still below the 2.2% annual inflation rate.

EBA head José Manuel Campa last week called for "more action" on implementing Draghi's finance-related proposals and Letta warned last month the SIU would fail if it remained "confined to financial market insiders".

Money managers such as Milan-based Anthilia SGR welcome the SIU, including a recent proposal for tax-advantaged savings and investment accounts, but say they risk remaining on paper without national follow-through.

Casper Rutting, senior supervision officer at the AFM, called attention to an often overlooked cultural dimension.

"The lack of trust is linked to problems such as biased advice or high fees," he said.

This is key for retired Italian doctor Renzo Le Pera.

"To invest the fruit of your life's work you need to be either very savvy or fully confident in those who'd do that for you. I'm neither," the 73-year-old said.

"My bank is hard to reach by phone, yet they do ring me to propose investments which the fees make rather unappealing: I may be no expert, but I'm not stupid," he added.

($1 = 0.8596 euros)

Reuters

Link nội dung: https://news.tuoitre.vn/eu-takes-small-steps-in-uphill-struggle-to-wean-savers-off-cash-103251202145127704.htm