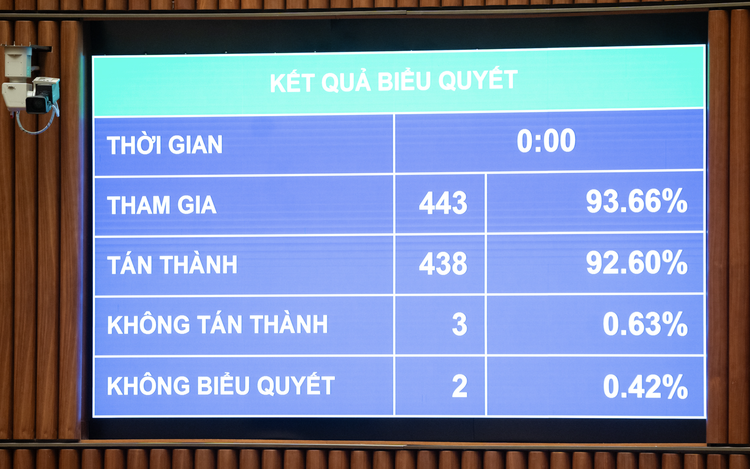

438 out of 443 National Assembly (NA) deputies present at the NA sitting on December 10, 2025, vote in favour for the revised Personal Income Tax Law. Photo: P. Thang / Tuoi Tre

The amended law, with 92.6 percent approval, aims to modernize tax administration and tighten oversight of sectors that have long influenced market stability.

It consists of 30 articles and takes effect on July 1, 2026.

Taxpayers include individuals earning income from business activities, wages and salaries, capital investment, capital transfers, real estate transfers, winnings, royalties, franchising, inheritance, gifts in the form of securities or capital shares, as well as emerging sources such as digital asset transfers and gold bullion transactions.

One of the most notable changes is the clearer framework for taxing household business income.

Individuals with annual business revenues of VND500 million (US$18,970) or less will not be subject to personal income tax.

For higher revenue brackets, the following tax rates apply:

– Over VND500 million to VND3 billion ($18,970- $113,820): 15 percent

– Over VND3 billion to VND50 billion ($113,820 - $1.9 million): 17 percent

– Above VND50 billion ($1.9 million): 20 percent

The revised law also introduces more detailed rules on taxing real estate transfers.

The tax is set at two percent of the transfer value.

Taxable income is determined either when the transfer contract takes legal effect or when ownership or usage rights are officially registered.

Another significant addition concerns taxation on gold bullion transactions.

After extensive review and consultation, the law establishes a 0.1 percent tax rate on each gold bullion transfer.

The government is tasked with defining the taxable threshold, timing of implementation, and future adjustments to the tax rate in line with gold market management policies.

Minister of Finance Nguyen Van Thang said that empowering the government to stipulate these details ensures that individuals who buy and sell gold merely for savings or storage, not for business purposes are not unnecessarily burdened.

The new provision is essential given its wide impact.

It aims to strengthen the oversight of gold trading, curb speculation in gold, and mobilize social resources to contribute to the economy.

Max: 1500 characters

There are no comments yet. Be the first to comment.