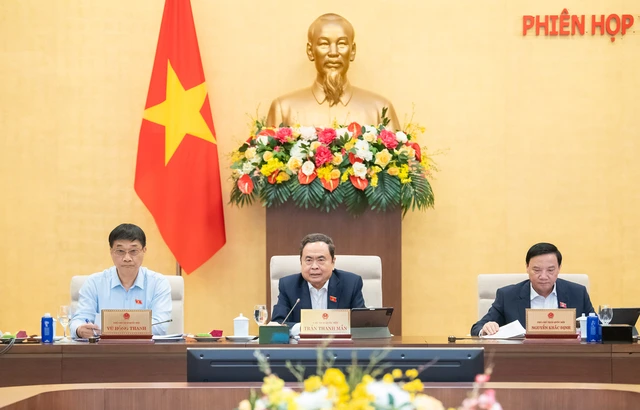

A general view of the Vietnamese law-making National Assembly’s working session on May 16, 2025. Photo: Gia Han

The NA was scheduled to vote on the resolution on Saturday, following a discussion by its Standing Committee on Friday evening.

The draft resolution introduces a range of special mechanisms to support private economic development, including streamlined tax policies and reduced regulatory burdens.

Nguyen Duc Tam, Deputy Minister of Finance, confirmed that the draft resolution reflects the direction of the Politburo’s Resolution 68, which calls for greater institutional support for SMEs.

Under the current proposal, the tax exemption will apply for three years from the date a business receives its first registration certificate.

While some NA deputies suggested the exemption should begin once the business turns a profit, the NA Standing Committee ultimately backed the original approach, citing concerns about budget impacts if the policy’s scope were expanded.

The draft resolution also addresses concerns about excessive and overlapping inspections, which many businesses said have hampered their growth.

Under the new rules, each enterprise will be subject to no more than one inspection or audit per year, unless there is clear evidence of legal violations.

This is intended to curtail regulatory overreach and limit opportunities for corruption or harassment.

The central government plans to shift from on-site inspections to more remote, data-driven monitoring, using electronic records and greater coordination among government agencies.

Nguyen Duc Tam, Deputy Minister of Finance. Photo: Gia Han

Another notable element of the draft resolution is the planned abolition of the current presumptive tax regime for household businesses.

This change, originally scheduled for July 1, 2026, will now take effect on January 1, 2026.

The Finance Ministry said it has prepared educational materials and resources to ensure household businesses understand and adapt to the new tax system.

The draft resolution also includes a provision regarding the handling of assets seized during criminal investigations.

Lawmakers have called for clearer guidelines to ensure that evidence and confiscated property are processed efficiently and put to productive use as early as possible. This is aimed at preventing waste, recovering losses, and better safeguarding state and private interests.

After reviewing two options for each key proposal, the Standing Committee unanimously chose to move forward with the central government’s original recommendations.

The NA’s vice-chair Vu Hong Thanh said the revised draft had incorporated feedback from lawmakers and was ready for final approval.

Max: 1500 characters

There are no comments yet. Be the first to comment.