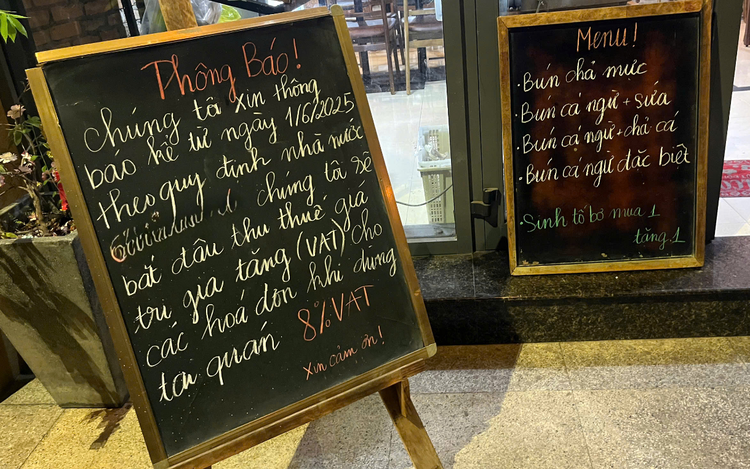

A sign notifies customers of VAT charges at an eatery in Ho Chi Minh City. Photo: N.B. / Tuoi Tre

This change followed a new mandate requiring businesses to connect directly with tax authorities through digital invoicing systems.

Under the new regulation, some 37,000 household and individual businesses with annual revenues exceeding VND1 billion (US4 38,300) are now required to use electronic invoices generated via point-of-sale systems that are directly linked to the tax authorities.

Businesses with lower revenues are exempt from the mandate, but are encouraged to adopt the system.

Circular 40/2021 stipulates that businesses with annual revenues of VND100 million ($3,840) or less are exempt from VAT and personal income tax.

However, those with revenues above that threshold are subject to three types of levies, including business license fees, VAT, and personal income tax.

Many customers have already noticed changes in how bills are presented, especially at restaurants and retail shops.

Previously, VAT was only included when customers asked for official ‘red invoices.’

As observed by Tuoi Tre (Youth) newspaper, on the first day of the implementation, many businesses in Ho Chi Minh City were equipped with the necessary software and machines to comply with the new regulation.

However, others remained hesitant, citing a lack of detailed guidance and concerns over the financial burden of software and equipment upgrades.

Minh Lan, the owner of an eatery in Thu Duc City, shared that she is aware of the regulation but has not yet adopted the system due to time constraints and a lack of official instructions.

Pham Anh Tuan, head of the Payment Department at the State Bank of Vietnam, told Tuoi Tre on the sidelines of the press briefing on Monday to launch the Cashless Day 2025 that many market stalls have shut down due to difficulties in declaring taxes and unclear sourcing of input goods.

“People shopping in traditional markets usually don’t care about invoices or VAT, so goods are cheaper than those sold at supermarkets,” Tuan said.

However, if sellers must now increase prices to accommodate VAT, it could make their goods less competitive compared to supermarkets.

Many small business owners have called for a transition period and additional government support to ease the burden of compliance.

Estimated costs for meeting the new requirement range from a few million to several dozen million Vietnamese dong annually. (VND1 million = US$38.4)

Suggested support measures include free accounting software, tax reductions during the initial phase, and practical training on tax regulations.

According to the General Department of Taxation, the shift from a fixed tax regime to self-declaration and payment based on actual revenue ensures fairer taxation and aligns with the Tax Management Law’s principle of ‘self-declaration, self-payment, and self-responsibility.’

Resolution No. 68 on developing the private economy underscores the government’s commitment to effectively supporting micro and small enterprises.

Accordingly, the government is striving to create a legal framework that encourages household businesses to transition into enterprises.

The government also aims to fully abolish the fixed tax regime for household businesses by 2026 by accelerating digitalization, increasing transparency in accounting and taxation, and offering free access to shared digital platforms, legal consultancy services, and training in business management and related services.

Max: 1500 characters

There are no comments yet. Be the first to comment.