A Dien May Xanh consumer electronics retail store owned by MWG

The company booked financial revenue of VND693 billion (US$26.65 million) in the first quarter, up 18 percent from a year earlier.

Most of it came from interest on deposits, loans, and bonds, totaling VND636 billion ($24.46 million), with another VND56 billion ($2.15 million) from early payment discounts.

Pre-tax profit rose 60 percent year on year to VND1.93 trillion ($74.22 million), with financial activities contributing 36 percent of the total, according to its quarterly financial report.

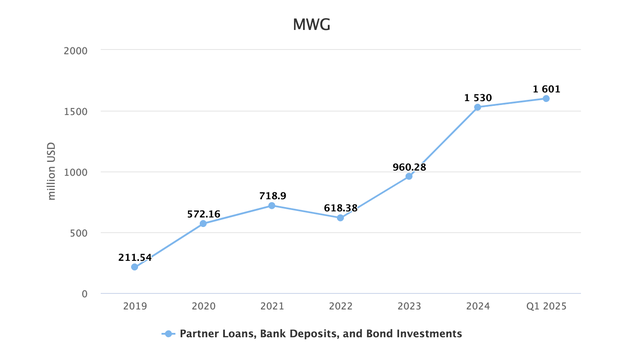

MWG, known as a major computer and electronics retailer in Vietnam, has increasingly turned to financial investments as a secondary revenue stream.

As of end-March, the company held nearly VND42 trillion ($1.62 billion) in short-term loans, deposits, bonds, and other interest-earning assets – the highest level to date.

Of that, VND7 trillion ($269.18 million) was short-term loans to corporate partners, while over VND22.3 trillion ($857.53 million) was held in bank deposits and VND12.3 trillion ($473 million) in bonds and other one-year investments.

Financial income has played a critical role in MWG's profit in recent years.

In 2024, MWG recorded VND2.38 trillion ($91.52 million) from financial operations, nearly half of its consolidated pre-tax profit.

In 2023, financial gains helped offset weak retail performance and kept the company out of the red.

While MWG's financial investments were minimal in 2020, equivalent to just 15 percent of its profit, the scale has grown significantly since late 2022.

The company has also expanded into financial services.

In late 2024, MWG signed a partnership with Vietnam Prosperity Joint Stock Commercial Bank (VPBank) to offer basic banking services at over 3,000 of its retail stores.

It also partnered with Vietnamese military-run telecom company Viettel to provide money transfers to bank accounts at store locations.

MWG reported VND220 billion ($8.46 million) in 2024 in early payment discounts and VND335 billion ($12.88 million) in 2023.

On the liabilities side, MWG reported VND26.2 trillion ($1 billion) in short-term debt at the end of Q1 2025, down four percent from the beginning of the year.

It had increased short-term borrowing in 2024, including VND20.8 trillion ($799.85 million) in unsecured bank loans due in April 2025.

At its 2025 annual shareholders' meeting, CEO Vu Dang Linh said the company's core business remains retail, but its strong cash flow allows it to selectively pursue financial investments.

He added that MWG maintains a cautious approach, focusing on bank deposits and working with trusted partners.

Max: 1500 characters

There are no comments yet. Be the first to comment.