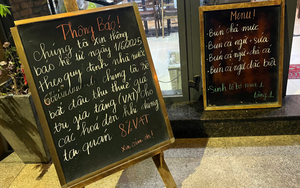

Many small businesses ask customers not to mention goods in payment descriptions. Photo: B.K. / Tuoi Tre

Starting June 1, 2025, all household businesses with annual revenues over VND1 billion (US$38,300) are required to issue e-invoices generated from point-of-sale (POS) systems that connect directly to the tax authority’s database.

On several tax-related forums, business owners have voiced anxiety about these new rules.

In the past, it was common to use handwritten receipts or sell goods without invoices.

However, under the new system, a legitimate input invoice is required before a business can legally resell goods and issue an output invoice.

Lawyer Nguyen Thanh Phong from the Hanoi Bar Association explained to Tuoi Tre (Youth) newspaper that input invoices – those received when purchasing goods or services for business use – are essential for accounting, tax deductions, and final tax settlements.

"Businesses cannot issue output invoices if they don't have input invoices," Phong said.

Issuing output invoices without proper input documentation is a legal violation and can result in administrative fines of up to VND8 million ($306).

In more serious cases, it could lead to criminal charges for tax evasion.

However, there are exceptions.

Under Clause 2, Article 3 of Circular 119/2014, businesses are not required to issue VAT invoices or pay VAT for certain activities, such as borrowing or renting equipment, as long as there are contracts and clear documentation.

Do online sellers need a point-of-sale system?

Experts confirmed that online household businesses with annual revenues above VND1 billion must also use e-invoices with tax codes generated through a POS system.

Lawyer Phong said this applies to businesses that sell directly to consumers, including retailers (excluding stores selling vehicles), supermarkets, restaurants, hotels, cinemas, entertainment venues, and passenger transport service suppliers.

Phan Phuong Nam, vice-dean of the commercial law faculty at Ho Chi Minh City University of Law, said many small traders have relied for years on handwritten invoices.

Adapting to the new system will take time, especially because it requires sourcing supplies from vendors that provide proper input invoices.

He also emphasized the need for clearer guidelines on what to do with existing inventory that lacks documentation.

Without such guidance, he warned, the new rules could spark panic among small retailers.

Don’t try to evade tax duties

Tax experts cautioned that both ignorance and intentional evasion can carry serious consequences under today’s more transparent legal framework.

A tax official noted that many small retailers still rely on cash transactions to avoid declaring full revenues, but with data analytics and electronic systems, tax agencies can cross-check information such as invoices, bank flows, and delivery records to identify discrepancies.

“Paying taxes is a legal duty,” the official said.

"Doing it fully and correctly is also the foundation for building a transparent, stable, and sustainable business.”

Max: 1500 characters

There are no comments yet. Be the first to comment.