A The Gioi Di Dong store operated by Mobile World Investment Corporation (MWG). Photo: MWG

In the third quarter, MWG posted a net revenue of VND39.85 trillion (US$1.5 billion), up 16.9 percent year on year, marking the highest quarterly revenue in the company’s history.

Its net profit after tax more than doubled to VND1.78 trillion ($67.6 million).

The company’s cost of goods sold increased faster than its revenue, limiting gross profit growth to nine percent and narrowing gross margins to 18.8 percent from 20.2 percent a year earlier.

Selling expenses fell six percent thanks to reduced outsourced services and depreciation, while administrative costs jumped 16 percent to VND1.12 trillion ($42.5 million), largely due to higher personnel expenses.

As of September, MWG employed 61,201 people, down nearly 2,000 from the start of 2025 but up 943 from the same period last year.

The company's financial income also contributed to the profit surge, climbing 41 percent year on year to VND809 billion ($30.7 million) on stronger returns from interest, investments, and bonds.

MWG, which holds one of the largest cash reserves among Vietnam’s non-financial firms, reported VND39 trillion ($1.48 billion) in cash, deposits, and investments by the end of September, up nearly VND4.8 trillion ($182.3 million) since the start of the year.

A screenshot of perfomance updates from MWG’s year-to-date September 2025 report. Photo: MWG

Short-term loans receivable rose 30 percent to VND7.88 trillion ($299.3 million), while short-term borrowings increased five percent to VND28.7 trillion ($1.1 billion).

Interest expenses totaled more than VND1.08 trillion ($41 million) in the first nine months.

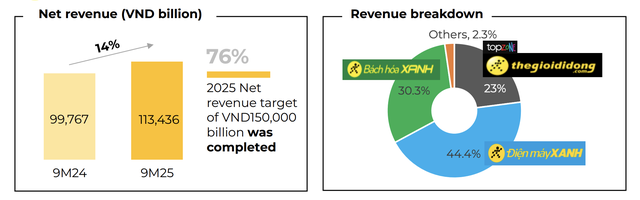

For the first nine months of 2025, MWG recorded cumulative revenue of VND113.6 trillion ($4.3 billion), up 14 percent from last year, and a record net profit of VND4.99 trillion ($189.5 million), representing a 73 percent year-on-year increase.

The results placed the company, chaired by Nguyen Duc Tai, at 76 percent of its full-year revenue target and slightly above its profit goal.

Within MWG’s portfolio, Dien May Xanh electronics stores contributed 44.4 percent of the total revenue, Bach Hoa Xanh grocery stores 30.3 percent, and The Gioi Di Dong (including TopZone) 23 percent, with the rest coming from smaller business lines.

MWG shares have climbed more than 23 percent over the past three months, closing Thursday at VND85,700 ($3.25), their highest level in three months.

Max: 1500 characters

There are no comments yet. Be the first to comment.