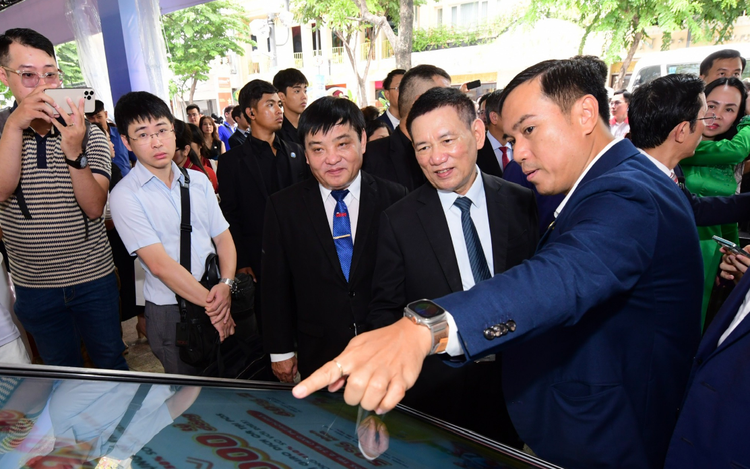

Deputy Prime Minister Ho Duc Phoc (R, 2nd) attends the cashless day festival in Ho Chi Minh City on June 14, 2025.

Speaking at the seminar, the deputy prime minister praised the initiative’s theme ‘Cashless Payments Driving the Digital Economy’ as both timely and meaningful.

Organized for the seventh consecutive year by Tuoi Tre (Youth) newspaper in coordination with the State Bank of Vietnam and the Ho Chi Minh City People's Committee, the Cashless Day program aims to promote digital financial inclusion and economic modernization.

“To protect residents during the transition to a cashless society, especially from fraud and cybercrime, we must enhance digital security and improve online crime prevention,” the top official stressed.

He highlighted that developing robust IT infrastructure is a prerequisite for a thriving digital economy, with cashless transactions playing a pivotal role, particularly in e-commerce.

According to Deputy PM Phoc, the benefits of digital payments go beyond speed and convenience, they also reduce transaction costs significantly.

“Even over thousands of kilometers, businesses and individuals can complete transactions within seconds, demonstrating the power of a digital economy,” he noted.

Data from the central bank indicated that at the end of 2024, Vietnam had more than 204.5 million personal payment accounts and 154.1 million active bank cards.

Nearly 87 percent of adults now own a bank account, while essential services such as education fees, healthcare, transportation, and shopping are increasingly being digitized, helping cut costs for firms and improve convenience for consumers.

He called this a promising sign for Vietnam’s digital economy.

He also reaffirmed the government's strong commitment to digital transformation, underpinned by policies and legal frameworks such as the Politburo’s Resolution 57, the Law on Electronic Transactions, the Telecommunications Law, the Cybersecurity Law, and the Law on Personal Data Protection.

“These legal foundations are paving the way for a comprehensive digital ecosystem, with cashless payments serving as a key catalyst,” he underscored.

Challenges to overcome

However, he acknowledged significant hurdles that remain.

Cash usage persists in some communities, digital infrastructure is still uneven in remote areas, and cybersecurity threats continue to escalate.

Legal gaps, especially concerning cryptocurrencies and cross-border payments, also hinder broader implementation.

To address these challenges, he called for a comprehensive strategy that integrates policy, infrastructure, technology, and public awareness.

He urged the relevant units to complete a legal framework for cross-border payments.

The government is prioritizing investments in next-generation infrastructure such as 5G and 6G networks, and nationwide fiber-optic cables, so leading tech firms are expected to play a core role in building this digital backbone.

He suggested banks continue innovating by offering new, user-friendly payment solutions.

It is critical to educate the public and businesses on the benefits of going cashless, as changing payment habits requires deep awareness, he said.

The deputy prime minister also commended Tuoi Tre for pioneering and sustaining the Cashless Day initiative, recognizing the contributions of banks and businesses in pushing digital transformation forward.

Do Que Anh, deputy director of digital banking at MBBank, speaks at a seminar, part of the Cashless Day festival in downtown Ho Chi Minh City, June 14, 2025. Photo: Quang Dinh / Tuoi Tre

AI as shield against fraud

Addressing the event, Do Que Anh, deputy director of MBBank’s digital banking division, highlighted the growing sophistication of online scams which often deceive unsuspecting users.

In response, MBBank has utilized artificial intelligence (AI) as a technology shield to protect customers' finances.

AI technology is now detecting unusual transaction patterns, identifying fake interfaces that trick users into entering sensitive data.

It is also capable of spotting deepfakes and tracking accounts linked to fraudulent activity using a constantly updated scam database.

MBBank has integrated security measures from the moment a user logs into the app, detecting devices infected with malware and stopping threats before transactions occur.

Apart from enhancing customer security and preventing losses, AI has also reduced fraud cases by up to 95 percent, and helped the bank lower production costs and improve its service quality, she said.

Exploring cryptocurrency regulation

Deputy PM Phoc confirmed that Vietnam is considering a regulatory framework for digital assets, including cryptocurrencies.

“We currently have no specific legislation for virtual assets or crypto, but the government has assigned the Ministry of Finance and the State Bank to study and draft pilot regulations,” he said.

Although the field is complex and carries high risks, he acknowledged that Vietnam will not stand aside.

Some nations have recognized cryptocurrencies like Bitcoin.

“This is something we need to carefully study and approach step by step,” he said.

The Cashless Day 2025 program was officially launched in early June, co-organized by the State Bank of Vietnam's Payment Department, Tuoi Tre, Thoi Bao Ngan Hang (Banking Times), the Ho Chi Minh City Department of Industry and Trade, and the National Payment Corporation of Vietnam (Napas), with guidance from the central bank and the municipal People’s Committee.

Max: 1500 characters

There are no comments yet. Be the first to comment.